Securing affordable health insurance is crucial in safeguarding your well-being without straining your finances. With a myriad of options available, navigating the complex landscape of health insurance can be overwhelming. This guide aims to assist you in identifying the best affordable health insurance options, ensuring you make an informed choice that suits your needs and budget.

Understanding the Basics of Health Insurance

Health insurance is a contract between you and an insurance company, offering financial coverage for medical expenses. It’s important to comprehend the fundamental aspects:

Premiums: The amount you pay for your health insurance policy, usually on a monthly basis. Deductibles: The sum you must pay before the insurance starts covering costs. Co-pays: Fixed amounts paid for certain services after the deductible is met. Coverage: The services and treatments covered by the insurance plan.

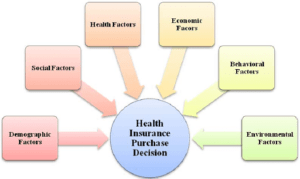

Factors Influencing Affordable Health Insurance

Several elements impact the affordability and suitability of health insurance:

Network Coverage: Check if your preferred healthcare providers are in the insurance network. Type of Plan: HMO, PPO, EPO, or POS plans have distinct features affecting cost and coverage. Prescription Coverage: Assess the inclusion of prescription drugs in the plan. Out-of-Pocket Costs: Understand the maximum limit you might spend yearly. Government Subsidies: Consider available financial assistance through government programs.

Best Affordable Health Insurance Options

- Health Maintenance Organization (HMO) Plans:

- Lower premiums but limited network options.

- Requires a primary care physician referral for specialists.

- Preferred Provider Organization (PPO) Plans:

- Offers more flexibility in choosing healthcare providers.

- Higher premiums but fewer restrictions on specialists.

- Exclusive Provider Organization (EPO) Plans:

- Cost-effective with in-network coverage only.

- No out-of-network coverage.

- Point of Service (POS) Plans:

- Blends HMO and PPO features, allowing in and out-of-network coverage.

- Requires referrals for specialists but offers cost savings.

Tips for Finding Affordable Health Insurance

Comparison Shopping: Obtain quotes from various insurers to compare costs and benefits. Utilize Health Insurance Marketplaces: Explore state or federal exchanges for affordable plans. Consider High Deductible Plans: High deductibles often mean lower premiums. Understand Subsidies and Tax Credits: Check if you qualify for financial assistance. Review Plan Benefits: Ensure the coverage aligns with your medical needs.

Securing the best affordable health insurance necessitates careful consideration of your health needs and financial capabilities. By understanding the basics of health insurance, exploring various options, and considering essential factors, you can make an informed decision that provides both adequate coverage and affordability.